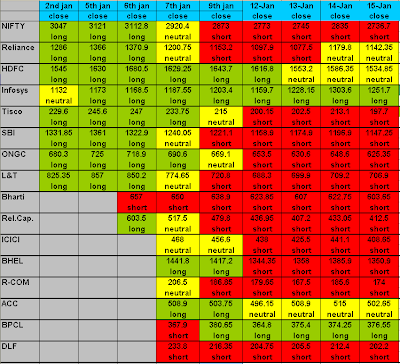

trading is a zero sum game..............Here money goes from the emotional traders tothe mechanical traders.******Trading system update for NIFTY. (3121)******~BIAS –positive. (3d HMA- 3084, 3d LMA-3014)

~MOMENTUM – positive. (3d SMA- 3067, 8d SMA-2980)

~TREND – positive. (8d SMA-2980, 34d SMA-2855)

~Weekly close at 3047.

Ø STRATEGY-

*Positional—

long (100%)

*stop loss – 3d SMA (50%)-

3067 & 3d HMA (50%)-

3014.

(our trading system generated long call when nifty closed at 2979).

*********TRADING SYSTEM UPDATE FOR STOCKS**********

******Trading system update for RELIANCE. (1366)******

~BIAS –positive. (3d HMA- 1313, 3d LMA-1261)

~MOMENTUM – positive. (3d SMA- 1302, 8d SMA-1261)

~TREND – positive. (8d SMA-1261, 34d SMA-1209)

~Weekly close at 1286.

Ø STRATEGY-

*Positional—

long (100%)*stop loss – 3d SMA (50%)-

1302 & 3d HMA (50%)-

1261.

(our trading system generated long call when reliance closed at 1286).

******Trading system update for hdfc. (1630)******

~BIAS –positive. (3d HMA- 1575, 3d LMA-1512)

~MOMENTUM – positive. (3d SMA- 1560, 8d SMA-1514)

~TREND – positive. (8d SMA-1514, 34d SMA-1486)

~Weekly close at 1545.

Ø STRATEGY-

*Positional—

long (100%)*stop loss – 3d SMA (50%)-

1560 & 3d HMA (50%)-

1512.

(our trading system generated long call when hdfc closed at 1533).

******Trading system update for infosys. (1173)******

~BIAS –

turned positive. (3d HMA- 1168, 3d LMA-1125)

~MOMENTUM –

turned positive. (3d SMA- 1151, 8d SMA-1137)

~TREND – negative. (8d SMA-1137, 34d SMA-1165)

~Weekly close at 1132.

Ø STRATEGY-

*Positional—

long (100%)*stop loss – 3d SMA (50%)-

1151& 3d HMA (50%)-

1125.(our trading system generated long call when infosys closed at 1173).******Trading system update for tisco. (245.6)******~BIAS –positive. (3d HMA- 237.8, 3d LMA-225.9)

~MOMENTUM – positive. (3d SMA- 234.6, 8d SMA-222.7)

~TREND – positive. (8d SMA-222.7, 34d SMA-195.1)

~Weekly close at 229.6.

Ø STRATEGY-

*Positional—

long (100%)

*stop loss – 3d SMA (50%)-

234.6 & 3d HMA (50%)-

222.7.

(our trading system generated long call when tisco closed at 228.7).

******Trading system update for sbi. (1361)******

~BIAS –positive. (3d HMA- 1352, 3d LMA-1315)

~MOMENTUM – positive. (3d SMA- 1336, 8d SMA-1299)

~TREND – positive. (8d SMA-1299, 34d SMA-1195)

~Weekly close at 1331.85.

Ø STRATEGY-

*Positional—

long (100%)

*stop loss – 3d SMA (50%)-

1336 & 3d HMA (50%)-

1315.(our trading system generated long call when sbi closed at 1169 on 4th dec.).

******Trading system update for ongc. (725)******~BIAS –

turned positive. (3d HMA- 706.2, 3d LMA-673)

~MOMENTUM – positive. (3d SMA- 696.8, 8d SMA-674.9)

~TREND – negative. (8d SMA-674.9, 34d SMA-680.3)

~Weekly close at 680.3.

Ø STRATEGY-

*Positional—

long (100%)

*stop loss – 3d SMA (50%)-

696.8 & 3d HMA (50%)-

673.

(our trading system generated long call when ongc closed at 684.8.).

******Trading system update for L&T. (857)******~BIAS –positive. (3d HMA- 841.9, 3d LMA-807.5)

~MOMENTUM – positive. (3d SMA- 834.8, 8d SMA-787.8)

~TREND – positive. (8d SMA-787.8, 34d SMA-767.7)

~Weekly close at 825.3.

Ø STRATEGY-

*Positional—

long (100%)*stop loss – 3d SMA (50%)-

834.8 & 3d HMA (50%)-

807.5.(our trading system generated long call when L&T closed at 821.8.).

******India VIX cosed at 43.11 and is at trendline resistance, so if breaks above then can cause major panic in market.

******India VIX cosed at 43.11 and is at trendline resistance, so if breaks above then can cause major panic in market.

-nifty still in sideway trend.

-nifty still in sideway trend.